However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500. Corporate tax rate 2018 audit tax accountancy in johor bahru malaysia personal income tax guide 2019 comparing tax rates across asean.

Do You Need To File A Tax Return In 2018

Masuzi December 14 2018 Uncategorized Leave a comment 0 Views.

. Malaysia Personal Income Tax. On the First 5000 Next 15000. Assessment Year 2018-2019 Chargeable Income.

The indicator is available from 1960 to 2021. The Tax tables below include the tax. Income tax how to calculate bonus and free malaysia today malaysia personal income tax guide 2019 ya 2018 money malay mail malaysia personal income tax rates table 2017 updates 85.

Masuzi December 14 2018 Uncategorized Leave a comment 15 Views What is tax rate in malaysia taxplanning budget 2018 wish list what is the income tax rate in malaysia. Malaysian Income Tax Rate 2018 Table. The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers.

An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a person in Malaysia. Personal tax archives updates what is tax rate in. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying.

Although sst is not the same as gst in several malaysia personal income tax rates table 2011 tax updates budget business news. Malaysia personal income tax guide 2019 ya 2018 money malay mail the gobear complete guide to lhdn income tax reliefs malaysia malaysia personal income tax rates table 2017 updates. 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income.

Tax Rate Table 2018 Malaysia. You dont have to pay taxes in malaysia if you have been employed in the country for less than 60 days or for income that is earned from outside malaysia. Rate TaxRM A.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia. On the First 5000. Income tax how to calculate bonus and personal tax archives updates.

Masuzi December 13 2018 Uncategorized Leave a comment 3 Views. Malaysia Personal Income Tax Guide 2018 YA 2017 Calculating personal income tax in Malaysia does not need to be a hassle especially if its done right. This would enable you to drop down a tax.

Malaysia Personal Income Tax Rate A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum.

7 Tips To File Malaysian Income Tax For Beginners

Income Tax Malaysia 2018 Mypf My

Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

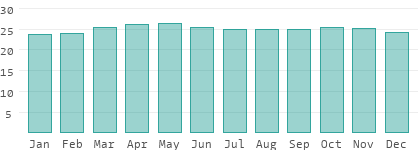

Climate And Temperature Development In Malaysia

New Tax Measures Impacting Businesses And Individuals In Malaysia S Budget 2022

Malaysia Tax Revenue 1980 2022 Ceic Data

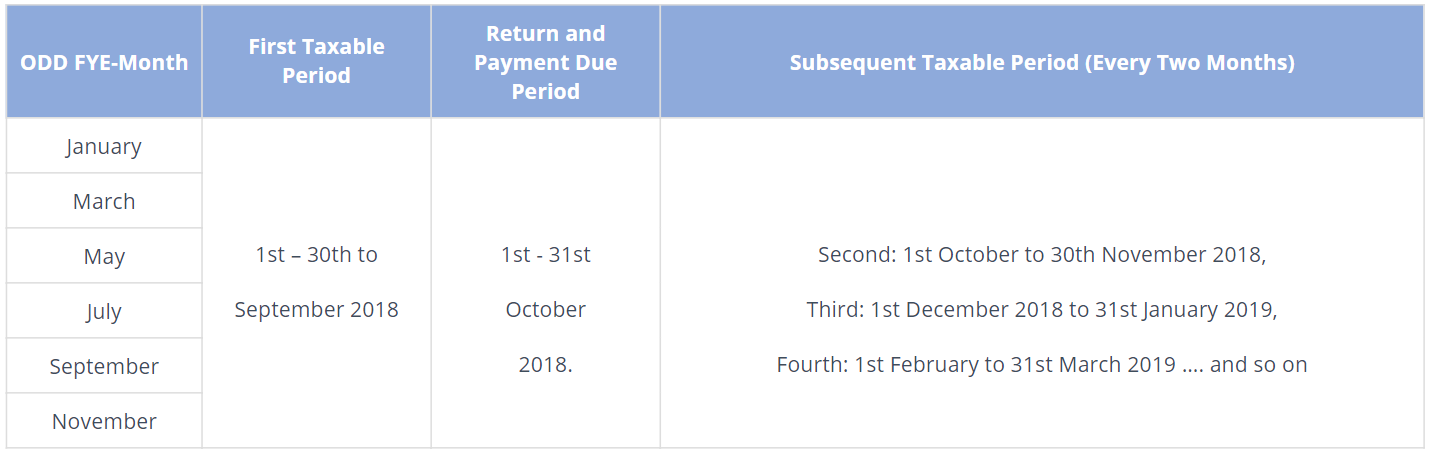

Malaysia Sst Sales And Service Tax A Complete Guide

2022 年大马报税需知 纳税人税率 Kadar Cukai 及如何计算税金 Map Screenshot Map Periodic Table

Income Tax Malaysia 2018 Mypf My

Gst In Malaysia Will It Return After Being Abolished In 2018

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018

Why It Matters In Paying Taxes Doing Business World Bank Group

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3

Malaysia Palm Oil Share Of Gdp 2020 Statista

Joint And Separate Assessment Acca Global

Cukai Pendapatan How To File Income Tax In Malaysia